Gold and Silver Explosion: Something Big Is Happening

by Brandon Smith

Gold and silver prices, according to Brandon Smith of Alt-Market.com, are signaling stress under the surface of the economy. From shrinking physical inventories to record central bank buying, precious metals warn that the underlying issues aren’t resolved…

In early 2020 at the beginning of the pandemic hysteria I noted that the covid panic seemed to perfectly coincide with the Federal Reserve’s acceleration of interest rates and asset dumping. This trend, I argued, was a precursor to a Catch-22 scenario I have been warning about for some time.

Since the crash of 2008, the central bank has used stimulus measures and near-zero interest rates to protect “too big to fail” corporations while keeping debt afloat globally. Doing this required the digital printing of tens of trillions of fiat dollars and, inevitably, a sharp devaluation in the greenback.

I predicted that this would lead to stagflationary conditions (which finally hit in 2022), and the conundrum of inflation vs. deflation.

The Federal Reserve could continue to keep rates low and ignore inflationary pressures to avoid a collapse of debt.

Or, they could significantly raise interest rates, let the debt system take its medicine and tumble in price and squelch the effects of inflation by suppressing consumer demand.

Either choice could cause an economic crisis.

Maybe it’s understandable that the Fed decided not to choose.

Instead, they raised rates but not enough to reverse stagflation. They took the middle road and refused to allow the economy to take its much-needed medicine, postponing a reckoning for badly-priced malinvestments.

Essentially, kicking the can down the road for the next administration to deal with.

Consequences of the Fed’s too-little-too-late strategy

This means we are still stuck with the massive price increases we incurred during the Biden Administration.

Granted, the rate of inflation has slowed. But the cost of living is significantly higher than just five years ago. (Remember, above-zero inflation doesn’t mean prices fall – it means they keep rising, but more slowly.)

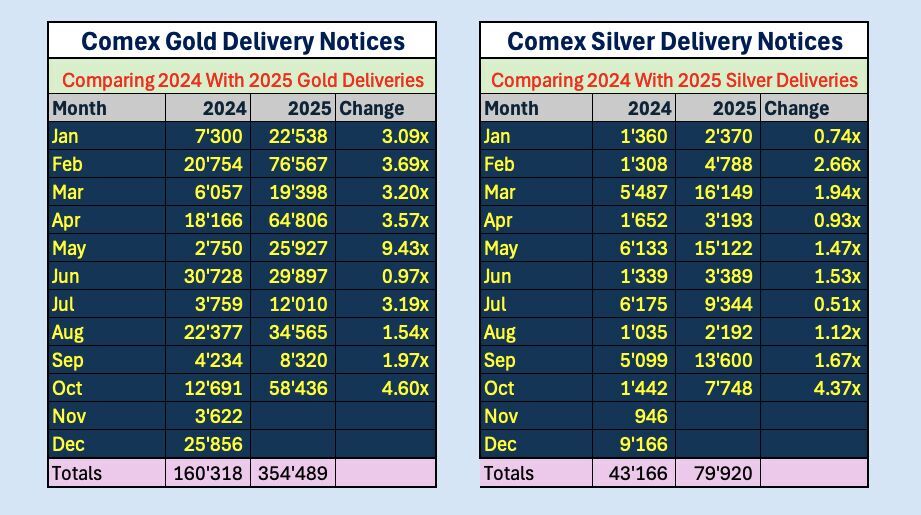

In 2020 I wrote an article titled Physical Gold Will Soon Break Free from the Paper Market in Spectacular Fashion, predicting skyrocketing precious metals values once this Catch-22 situation became apparent to investors. I predicted that buyers would increasingly drop financial derivatives (futures etc.) in favor of physical delivery of gold and silver, causing physical prices to go parabolic.

This is now happening.

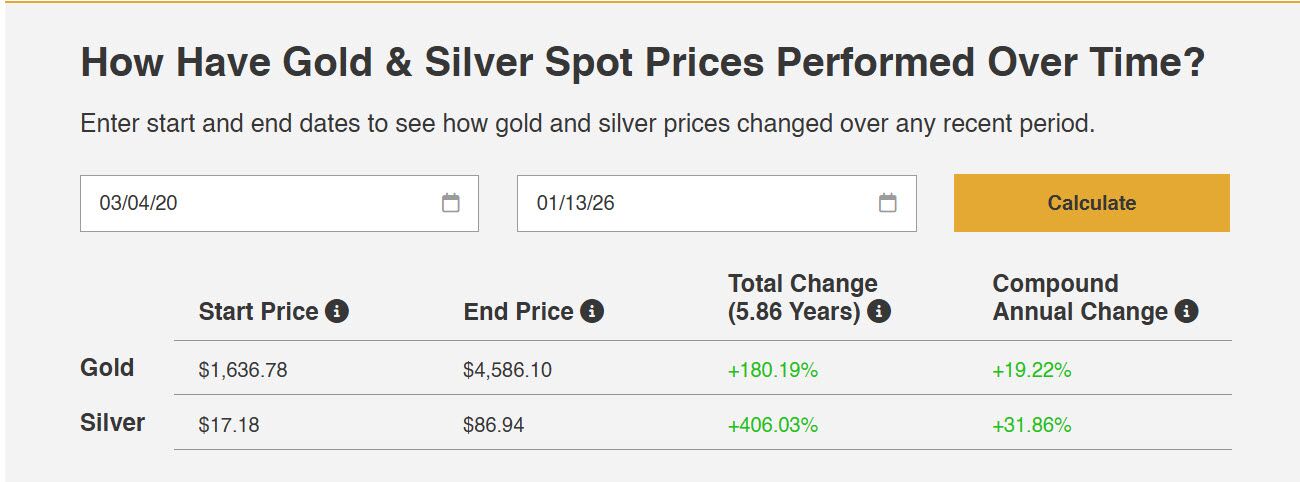

Since I wrote that article, the price of gold per ounce jumped over 200%. Silver prices have exploded by 400%.

- Global inventories of physical metals have plunged

- London vaults are reportedly down 30% since 2022

- Refiners report 10-14 week delays for new bullion bars (vs. normal 2-4 weeks)

- Physical redemptions of commodities contracts have accelerated to historically unprecedented levels

Silver is sitting at an all time high of $90 an ounce as I write this. Gold is closing in on $4700 per ounce.

(Maybe large banks like JP Morgan are deliberately backing away from market manipulation for some reason?) Global central bank gold buying has reached historic levels every year since 2022, surpassing even the levels we saw in the wake of the Great Financial Crisis.

All that is background – what does it mean?

The economic singularity

It seems to me that we are witnessing an economic singularity – a moment of great change.

Or, at the very least, the warning signs of an imminent change.

Precious metals prices are trying to tell us something.

The problem is, that message is mostly being ignored, even by more conservative platforms. Not enough people are talking about what’s happening with precious metals and what it means for the economy as a whole.

Here’s what I think…

First, the rush to physical assets suggests that banking institutions, governments and the wealthiest 1% of investors are scrambling to hedge in preparation for a true crisis. (I’m specifying institutions and the very wealthy because a single COMEX gold delivery contract represents 100 oz. of gold, nearly half a million dollars at today’s prices – well outside the typical American family’s means.)

As I noted in 2020, when the banks start rushing to buy physical gold and silver, then the rest of us should do the same. They are likely acting to counteract losses in other assets. Or they are forecasting some kind of geopolitical earthquake that will send prices exploding.

It’s not hard to see the potential for geopolitical conflict right now. European governments have become increasingly hostile to the U.S. over tariffs. They keep trying to start World War III with Russia and so on.

Second, there are the domestic problems caused by protests against immigration enforcement. The deportation issue is merely a convenient excuse for wider conflict between the left and the right. (If ICE agents went home tomorrow and stopped their arrests, the left would find something else to riot about.)

Just as we witnessed in 2020, domestic chaos is a tool for political extortion. In the meantime, civil instability helps fuel the rise in metals.

Third, there are the tensions with Russia and China, who are not happy with the capture of communist dictator Nicolás Maduro. Venezuela’s oil exports have been vital to China’s industrial capacity. Though Venezuela’s supplies only made up around 4.5% of China’s imports, a loss of 4% or more in a volatile global market is unwelcome to say the least.

Venezuela has served as a launching point for military assets in the western hemisphere (including surveillance systems to watch the U.S.). Chinese and Russian weapons failed miserably against U.S. operations, which might lead to escalation going forward.

The larger effects of Maduro’s removal can’t be quantified yet, but they will be consequential.

Most Venezuelans seem overjoyed by their liberation from Maduro. The question is, can we avoid a long-term quagmire? Our military excels at blowing up enemies with precision, but we have a miserable track record at long-term military occupation.

Fourth, let’s not forget the protests in Iran and the potential for regime change there. I have no personal stake in terms of what happens in the Middle East. I think the U.S. should stay out of the mess as much as possible, but I have no illusions that Trump is going to quietly sit back and just watch. He’s proven to be a man of action.

I have to admit, his decisions on foreign policy have been surprisingly effective and welcomed by the populations involved – in most cases at least. That said, when geopolitical conditions shift so quickly, this inevitably sends shockwaves through the global economy. Even when the action is morally correct and strategically necessary, the consequences are unpredictable.

Finally, the Fed appears intent on cutting interest rates without ever addressing the original stagflationary problem. Consumer spending never went down. Debt accumulation, at the federal and the household level, continues to grow. Prices are still high on most goods compared to 2020. The U.S. has to suffer through at least a short-term deflationary period in order to correct for stagflation, and the banks have done everything in their power to avoid this.

In other words, if the Fed continues to cut rates then inflation will a comeback in 2026.

Here’s what happens next

I believe all the right factors are in play for a continued gold and silver run.

I would not be surprised to see silver close to the $200 per ounce mark by 2027. The combination of demand for all the various industrial uses of silver combined with the multi-year supply deficit, on top of the U.S. decision to declare silver a critical mineral – adding in China’s attempts to ban silver exporting PLUS the insatiable demand for silver as an investment? This is a combination of forces all but guaranteed to send price higher. And they aren’t any more “transitory” than the Covid-era inflation spike. I predict these forces will drive the gold/silver ratio to levels last seen during the spike of 2011 (35:1), which would put the price closer to $131 per ounce today.

I’m not seeing any indication that global pressures are going to slow down anytime soon. In fact, I think precious metals are telling us that things are about to get much more chaotic.

Today, maybe more than ever, owning physical gold and silver is a declaration of financial liberty. Of independence from the fiscal chaos of the Federal Reserve and federal government debt.

____

https://www.birchgold.com/blog/news/gold-silver-stress/