When I see data proving how insanely stupid the average American proves to be on a daily basis, I can’t fathom why they do what they do. The information below from The Kobeissi Letter is mind boggling for someone like me, who has never tried to keep up with the Joneses, has purposely lived beneath my means for decades, and sees a vehicle as a way to get from point A to point B, and not as a status symbol for my neighbors, friends and family, proving how rich and successful I’ve become.

Not only has the average price for a new vehicle breached $50,000 (that’s the freaking AVERAGE!!!!!!), but the maff challenged masses are financing $41,000 of this cost for 6 years at 7% to 8%. That means the average new car “purchaser” is paying about $750 per month for an asset whose value declines every day. They are essentially underwater on the loan when they drive the vehicle off the lot. From my perspective, this insanity is borne out by the fact my monthly payment for my home of 30 years was $689 per month before I paid it off.

The average price of a new car at $39,000 in 2020 was already outrageous in my mind, but the 28% increase since then to $50,000 is truly a function of consumer stupidity and proof the banking cabal and the Fed money printing machine incentivizes the stupid to do stupid things. Another example of the BLS bullshit CPI being reported as 3% can be seen in the fact that even though the price of a new vehicle has provably gone up by 28% since 2020, the government tells you the price has only gone up by 21%. They reduce the price increase because you can now push a button to heat your ass and it beeps at you if you drift too far left.

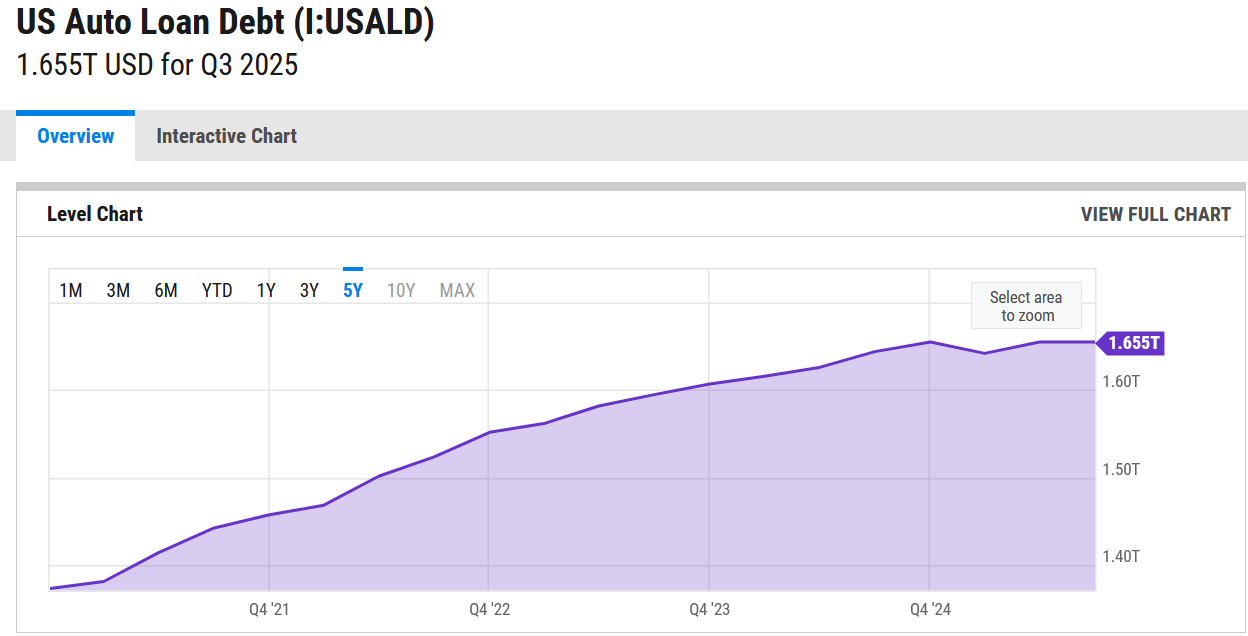

The real insanity can be seen in the rise in total auto loan debt from $1.35 trillion in 2020 to $1.65 trillion today. That is a 22% increase over the last five years. For some real perspective, the BLS reported real average weekly earnings of $377 in January 2020 and $387 in September 2025. Real wages are up 2.7% over the last five years, but the average dumbass thought it was a great idea to spend 28% more for a new car and incur 28% more debt for that car. This doesn’t even factor in the auto insurance rates going up 70% since 2020 ($1,500 to $2,600). The stupid truly burns.

The reason this behavior seems insane to me is because I haven’t bought a new car since 2010, and that was a cheap Honda hybrid for $20,000 because oil was $150 a barrel and I had a 60 mile daily round trip to work. We sold that vehicle two years ago after 13 years of dependable service. We currently own two 2012 Honda Civics which we bought used in the 2015 time frame for around $13,000 each. They both have just under 140,000 miles on them, and I have no intention of ditching them. Regular oil changes, new tires, and basic maintenance will sustain a Honda to 200,000 miles or more.

Our “new” car was purchased two years ago, a 2021 Honda HRV with about 27,000 miles on it for $22,000. The salesman at the dealership was flabbergasted when I pulled out my checkbook to pay in cash. Evidently, no one does that. When you don’t have a car payment for a decade, you can actually save up enough money to buy a nice basic used car from your savings.

I can’t comprehend why the vast majority are so ignorant of finances and so egocentric as to “need” the fanciest vehicle on the road. I understand the vehicle commercials bombarding us on TV every five minutes, but I can’t accept the idiocy of millions of morons borrowing tens of thousands to pay for a depreciating asset, just so other people will “think” they are rich. And don’t get me started on the 25% of people who lease their cars because they “need” new wheels every three years. These idiots are renting cars FOREVER.

Of course, idiocy and stupidity always have consequences. And the chart below gives the first glimpse of the disaster awaiting our economy as this debt bubble pops. We supposedly have a strong economy, with low unemployment. If so, why would auto loan delinquencies be at the levels of the 2008/2009 great financial crisis, and rising? Wait until the recession is officially acknowledged, layoffs accelerate, and the banking cabal tightens credit standards. The number of repossessed used cars available for my next purchase will be astronomical.

I will never feel sorry for anyone who decided to live above their means by borrowing $60,000 to drive a BMW, charged exotic annual vacations on their credit card, bought 6 bedroom McMansions with 5% down when they have 1 kid, ate out at restaurants four times per week on their AMEX, and generally were driven by ego and insecurity to appear successful when they were actually just stupid. A lot of personal bankruptcies are on the horizon.

____

https://www.theburningplatform.com/2025/12/10/you-cant-fix-stupid/