Hal Turner

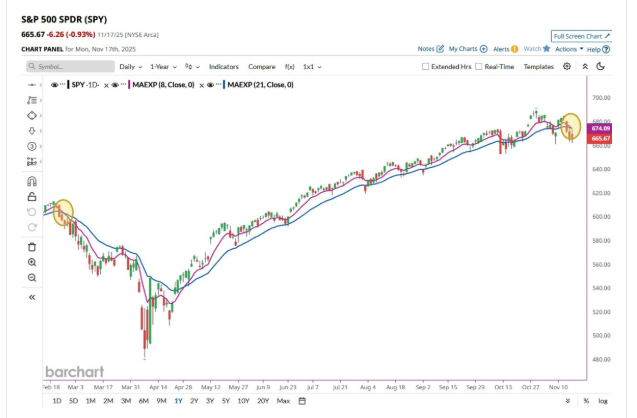

The 8-day EMA (Exponential Moving Average) is a short-term technical indicator that tracks an asset’s average price over the last eight days, with more weight given to recent prices. It is used by traders to identify short-term trend momentum, find potential entry or exit points during pullbacks, and confirm trends when used in combination with longer-term EMAs. It’s considered a faster-moving average, making it sensitive to recent price changes.

The last time this happened was back in February.

That last time sent the SPY plunging nineteen percent (19%) over the next six (6) weeks.

The SPDR S&P 500 ETF Trust is a very liquid exchange-traded fund which trades on the NYSE Arca under the symbol SPY.

The ETF is designed to track the S&P 500 index by holding a portfolio comprising all 500 companies on the index. It is a part of the SPDR family of ETFs and is managed by State Street Global Advisors.