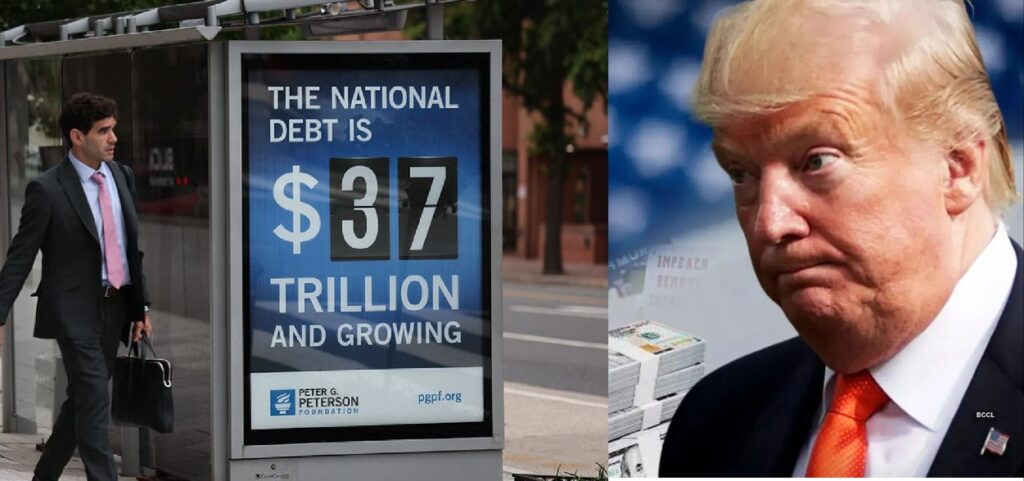

The United States has reached an unprecedented financial milestone as its national debt hits $37.9 trillion, according to the latest figures from the U.S. Department of the Treasury. This is officially the highest debt level in world history for a single nation. What is even more alarming is the speed at which it is growing — currently increasing by around $25 billion per day, a pace that is faster than during the Biden administration. Experts warn this trend could have serious implications for the U.S. economy, fiscal policy, and global financial stability.

The U.S. government’s total public debt combines two components — debt held by the public through Treasury securities and intragovernmental holdings such as Social Security and other trust funds. The figure stood at $37.9 trillion in mid-October 2025, marking an increase of more than $2.2 trillion in a single fiscal year. At this rate, the U.S. could surpass $40 trillion in debt by 2026, a level that was once projected to occur only near the end of the decade.

The often-quoted “$25 billion per day” figure refers to the average pace of debt growth over recent weeks. While this varies with Treasury borrowing schedules and cash flow timing, it reflects an accelerating deficit trend. Analysts calculate that the U.S. is now adding roughly $1 trillion in new debt every five months, compared to about $1 trillion every ten months during Biden’s presidency.

So, why is this happening faster now? The answer lies in a combination of larger fiscal deficits, higher interest costs, tax cuts, new spending programs, and structural economic pressures. In fiscal year 2025, the federal government spent about $7 trillion but collected only around $5.2 trillion in revenues — leaving a deficit of roughly $1.8 trillion. This gap must be financed through borrowing, which adds directly to the national debt.

A key factor is the rising cost of interest payments. As debt accumulates and interest rates remain high, the U.S. government is now spending more than $1 trillion annually just on interest — more than it spends on defense or Medicare individually. This creates a compounding problem: the government must borrow more money simply to pay interest on existing debt, leading to an accelerating debt spiral.

Policy choices under Donald Trump’s administration have also drawn criticism from economists and fiscal experts. The large-scale tax cuts and tariff policies, while politically popular, have reduced long-term revenue without offsetting spending reductions. The International Monetary Fund (IMF) has warned that the combination of tax cuts and higher discretionary spending could add over $4 trillion to U.S. deficits over the next decade. Although tariffs have generated record customs revenues, they are volatile and cannot sustainably offset massive fiscal shortfalls.

By contrast, while Biden’s era saw explosive debt growth during the pandemic, much of that increase was tied to emergency COVID-19 relief, infrastructure, and stimulus programs that had a defined endpoint. The current debt surge, however, is structural — built into ongoing tax and spending frameworks. This is why many economists argue that today’s situation is more concerning, as the U.S. is adding debt even during a period of economic expansion.

The IMF and Congressional Budget Office (CBO) both project that if current trends continue, the U.S. debt-to-GDP ratio could rise from about 125% in 2025 to over 140% by 2030, putting America’s fiscal path among the most unsustainable in the developed world. The risk is that rising interest costs could crowd out investment in key areas like education, infrastructure, and innovation. Moreover, sustained borrowing could eventually undermine investor confidence in U.S. Treasury bonds, which are currently the backbone of the global financial system.

Critics say the Trump administration’s approach to fiscal policy — large tax reductions without matching spending cuts, combined with new domestic programs and military commitments — has accelerated the problem. Supporters, however, argue that tax cuts stimulate growth, increasing overall revenues in the long run. Yet, data from the Treasury Department show federal receipts from corporate taxes have actually declined in 2025, while expenditures continue to rise.

Demographics also play a major role. The aging U.S. population is putting increasing pressure on Social Security and Medicare, which now consume the majority of federal spending. Without reforms to these entitlement programs, analysts warn that debt growth will remain uncontrollable regardless of which party governs.

Economically, this rising debt means the U.S. is approaching a dangerous inflection point. As the government borrows more, it risks pushing up interest rates, which can reduce private investment and slow growth. A heavier debt load also limits Washington’s ability to respond to future crises, such as recessions or wars, because fiscal space becomes constrained. This is why many economists believe the U.S. is entering a phase of “debt fatigue,” where even small policy shifts could have large financial repercussions.

For now, markets remain confident in the stability of U.S. Treasuries, largely because of the dollar’s status as the world’s reserve currency. But history shows that confidence can erode quickly once investors begin to question long-term sustainability. The Treasury Department itself has acknowledged that interest costs could exceed $12 trillion over the next decade if current borrowing patterns persist.

America’s debt clock is not just ticking — it’s racing.

✍️ This article is written by the team of The Defense News.